The Halal Products Development Company (HPDC) (a subsidiary of the Public Investment Fund), in partnership with DinarStandard, has launched the Saudi Arabia’s Halal Market Opportunity Report 2024/2025. The report highlights how the Kingdom, building on its deep cultural and spiritual heritage and guided by Saudi Vision 2030, is uniquely positioned to lead the global halal product and lifestyle economy.

Key Insights

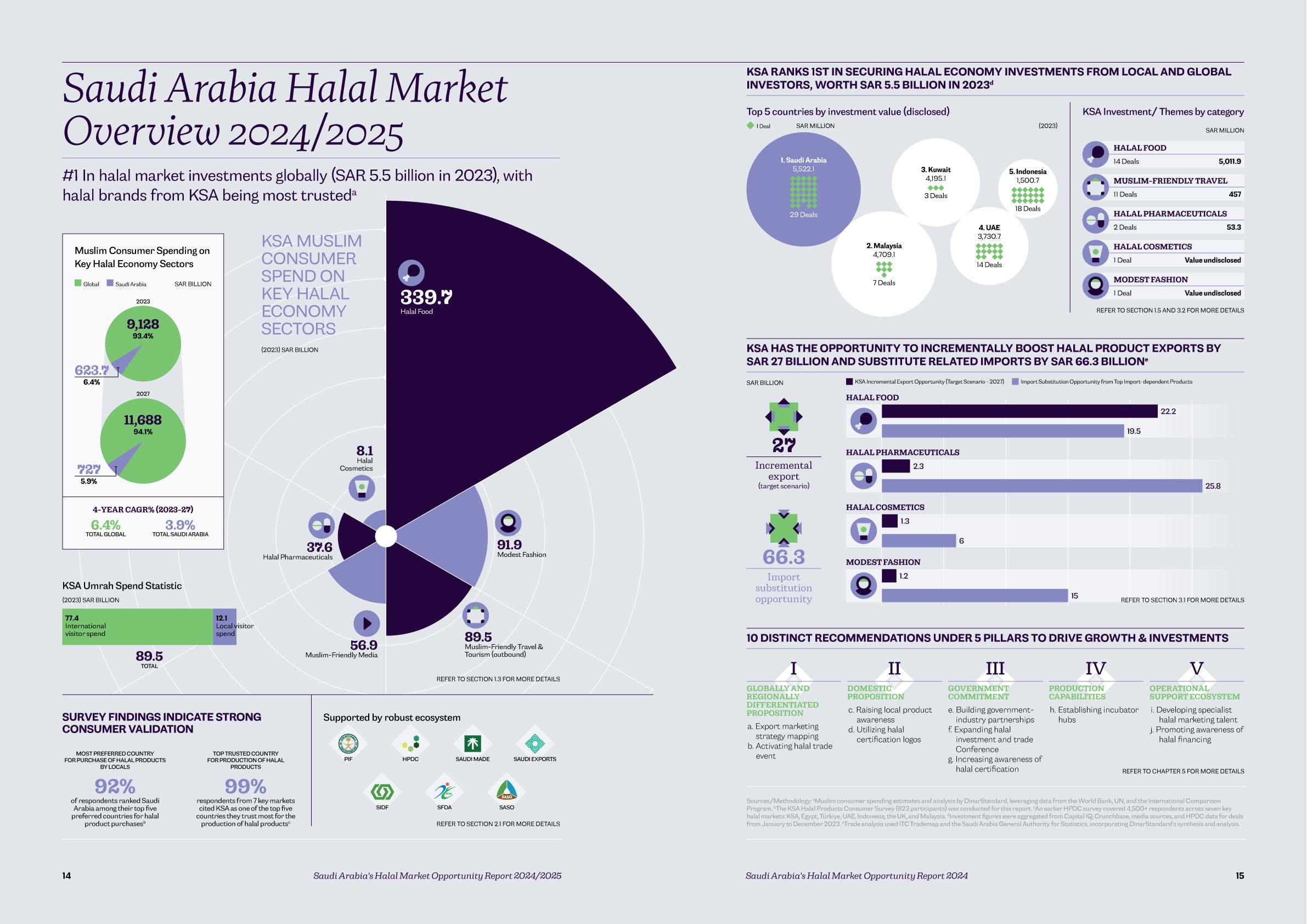

Spending on halal lifestyle products and services in Saudi Arabia reached SAR 623.7 billion (US$166.3 billion) in 2023, projected to grow to SAR 727 billion (US$193.9 billion) by 2027 at a 3.9% CAGR.

92% of Saudi consumers rank the Kingdom among their top five origins for halal products, while 99% of global respondents cite Saudi Arabia as one of the most trusted halal producers.

In 2023, Saudi Arabia secured SAR 5.5 billion (US$1.5 billion) in halal-related investments, making it the top global destination for halal economy investment flows.

Imports of halal products totaled SAR 124.4 billion (US$33.2 billion) in 2023, while exports to OIC countries are forecast to grow from SAR 19 billion ( US$5.07 billion) to SAR 27 billion (US$7.2 billion) by 2027.

Our Approach

Using its Key Drivers and Innovation Megatrends Framework, DinarStandard identified megatrend drivers and contextualized them for the halal economy, outlining 10-year innovation outcomes across different scenarios.

DinarStandard also leveraged its National Halal Economy Development Framework to develop 10 growth recommendations for Saudi Arabia to realize its leadership potential in the global halal industry. The framework linked the country’s halal economy to national economic growth and considered key factors, including the size of addressable demand, domestic and international competitiveness, current and potential trade capture, and priority opportunities for a comprehensive strategy.

Primary research included interviews and a survey conducted to gain grounded insights. Interviews were conducted with key government and private stakeholders. A survey of 823 Saudi residents was conducted on perceptions of halal-certified products and services.

More than 800 key trade relationships have been examined across 33 halal product categories to estimate Saudi Arabia’s incremental export opportunity. For each sector – food, pharmaceuticals, cosmetics, and fashion – different scenarios were developed based on Saudi Arabia’s share of global exports to OIC countries

Strategic Recommendations

The report provides 11 overarching growth recommendations and 10 promotion strategy recommendations for Saudi Arabia across the six halal economy sectors to achieve this goal, including:

Scaling domestic champions to compete globally.

Expanding exports across 18 high-potential halal product categories.

Reducing import dependency through local production.

Establishing a unified Saudi halal certification brand to strengthen global recognition.

Enhancing R&D, supply chain resilience, and talent development.

Mobilizing incubators, accelerators, and investment networks to drive innovation.

Aligned with Vision 2030, this report charts how Saudi Arabia can amplify its heritage and economic strength into a position of global leadership in the halal lifestyle economy.