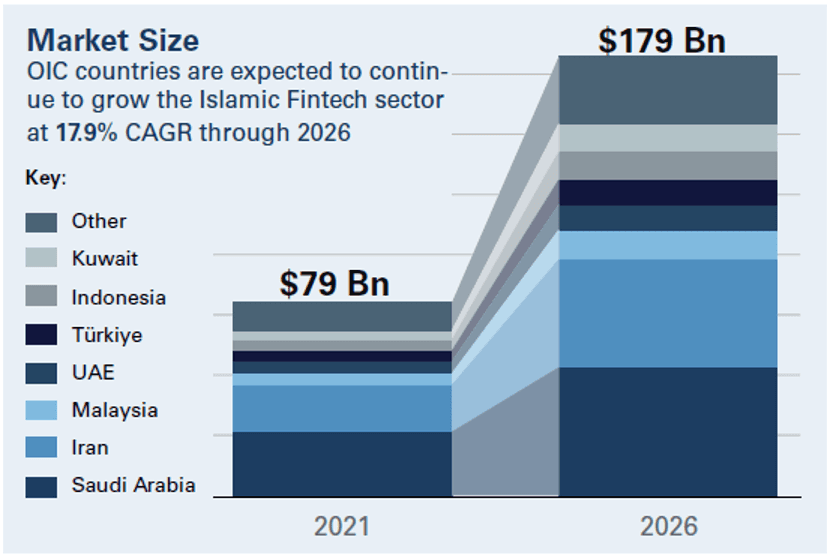

The global Islamic Fintech market is estimated at $79 billion in transaction volume (2021) and is expected to grow on average by 18% annually, to reach $179 billion by 2026.

The top six OIC Fintech markets by transaction volume for Islamic Fintech are Saudi Arabia, Iran, Malaysia, UAE, Turkey and Indonesia. Collectively, the Top 6 markets account for 81% of the OIC Islamic Fintech market size, indicating two dominant regional centers emerging amongst OIC countries for Islamic Fintech.

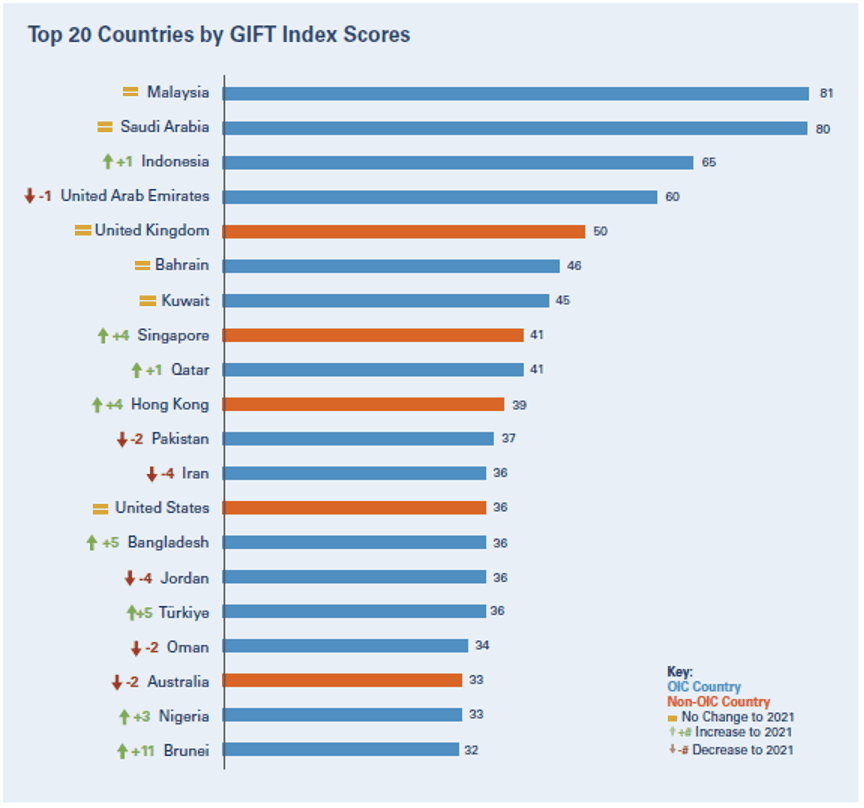

The Global Islamic Fintech (GIFT) Index

The GIFT Index ranked 64 country hubs on conduciveness for Islamic Fintech, with Malaysia and Saudi Arabia the standout jurisdictions, and Indonesia, the UAE and the UK forming the top five.

The GIFT index applied a total of 19 indicators across five different categories for each of the 64 countries. These five categories are: Talent; Regulation; Infrastructure; Islamic Fintech Market & Ecosystem; and Capital. Categories were weighted to derive an overall score, with a heavier weighting given to the Islamic Fintech Market & Ecosystem categories, since this is the most indicative by far of a country’s current conduciveness to Islamic Fintech specifically.

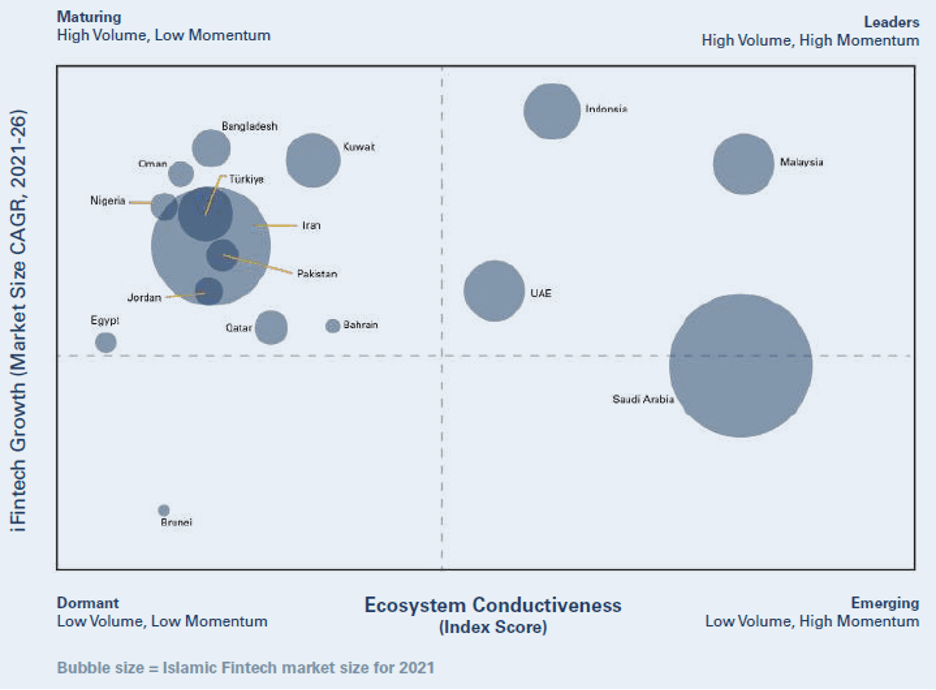

iFinetch Hubs Maturity Matrix

Malaysia, UAE and Indonesia are Leader Hubs, with Saudi Arabia moving from Emerging to Leaders. Bahrain, Bangladesh, Egypt, Iran, Jordan, Kuwait, Nigeria, Oman, Pakistan, Qatar and Türkiye are maturing with lower conduciveness to Islamic Fintech but display relatively high growth at the domestic level in market size.

Survey Responses

To gather the views of market players in the Islamic Fintech sector on a number of issues, two surveys were undertaken: one of Islamic Fintech industry professionals, and one of Islamic Fintech hubs. Respondents highlighted the greatest hurdles to be Customer Education, Access to Capital, Regulation, Finding Top Talent and the Cost of Customer Acquisition. Meanwhile, the respondents considered Payments, Deposits & Lending and Raising Funds as the top growth segments in 2022.

Gaps and Opportunities by Category

With the current macro environment, access to capital to make the most of the opportunities may remain limited for the foreseeable future. However, a recent trend toward specialist funds in Islamic Fintech provides some hope to the sector notwithstanding that valuations may be more conservative and appetite for capital intensive, low margin opportunities may be limited.

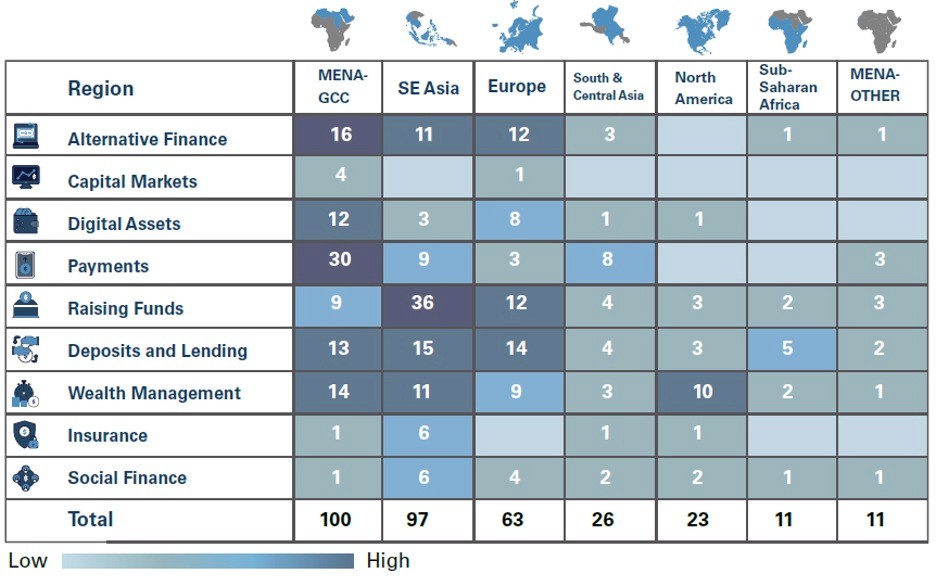

Gaps and Opportunities by Region

Opportunities persist across most verticals in South & Central Asia, North America, MENA-Other & Sub-Saharan Africa as well as in Capital Markets, Insurance and Social Finance verticals globally.

The Global Islamic Fintech (GIFT) Report 2022 was produced by DinarStandard and Elipses, a leading ethical digital finance advisory and investment firm.

The report was produced in partnership with SalaamGateway.com, the largest Islamic economy news and media platform. Strategic partners of this year’s GIFT Report include Qatar Financial Centre Authority (QFC), ALAMI, Aoin Digital, DDCAP GroupTM, IFIN Services, Asosiasi Fintech Syariah Indonesia (AFSI) and KNEKS.